Newsletters

Introducing Our AI Training Program for Financial Professionals

Financial professionals are embracing AI and data science to stay ahead of industry transformation. Skills development is the most critical step in this journey. However, current training programs fall short due to gaps between theory and practice, affordability, and the challenge of staying relevant with the rapidly evolving AI landscape.

The Physics of AI

Large language models (LLMs)’s capabilities have surprised both experts and the public. The physics of AI, as I call it, is the science of why and how these models work. So far, their success has been based on trial and error, much like the development of steam engine before the laws of thermo-dynamics were discovered. In this article, we delve into the intricacies of LLMs, exploring the mysterious behavior they exhibit and the need to understand their internal workings.

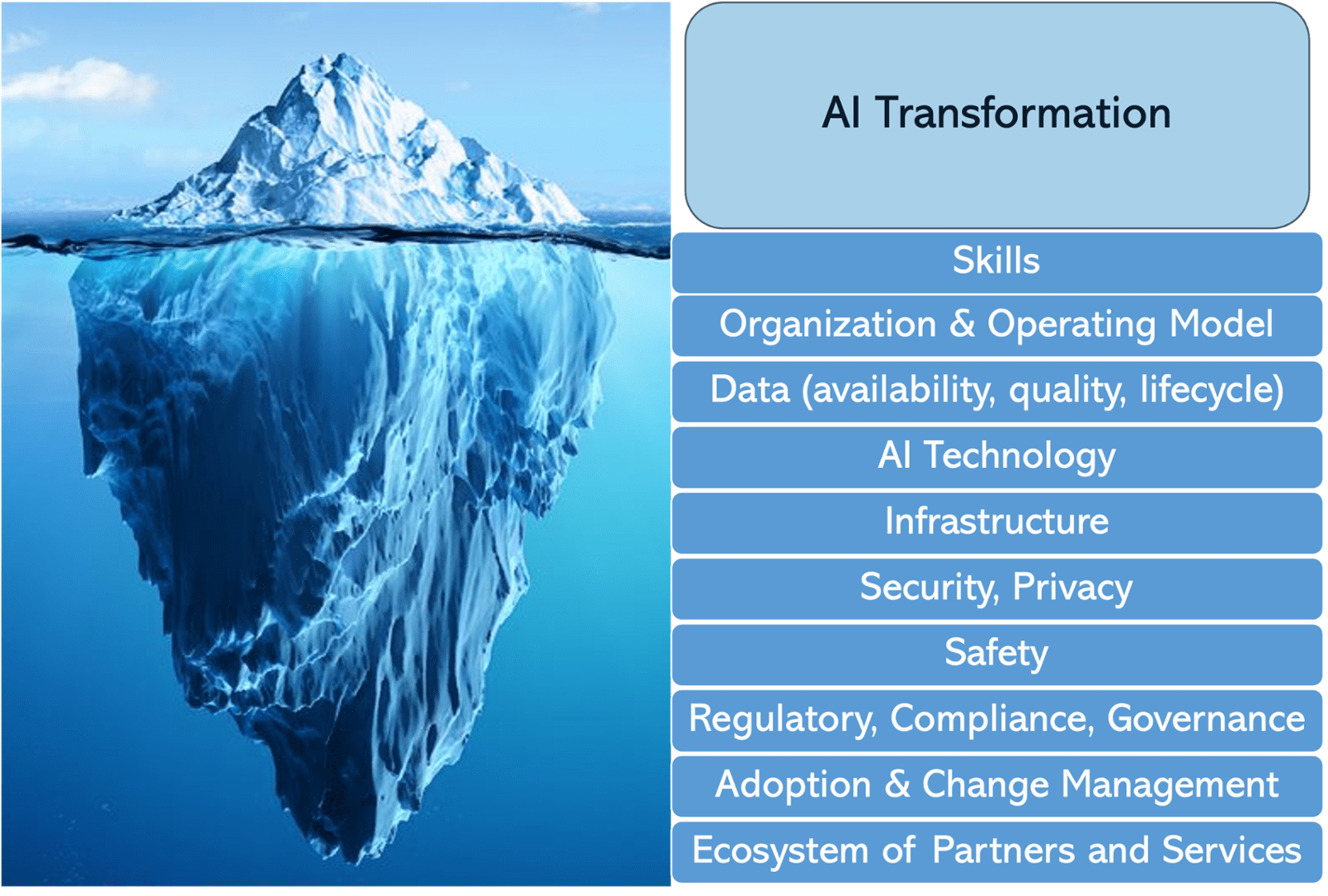

AI Transformation Foundations

95% of companies plan to deploy AI in their business, however, 71% are mired in pilots and experiments trying to figure out how to scale-up (BCG). In this article, we will discuss key foundational elements that need to be in place for AI scale-up. Much like an iceberg, majority of AI foundational capabilities are not visible at the experimental / pilot phase.

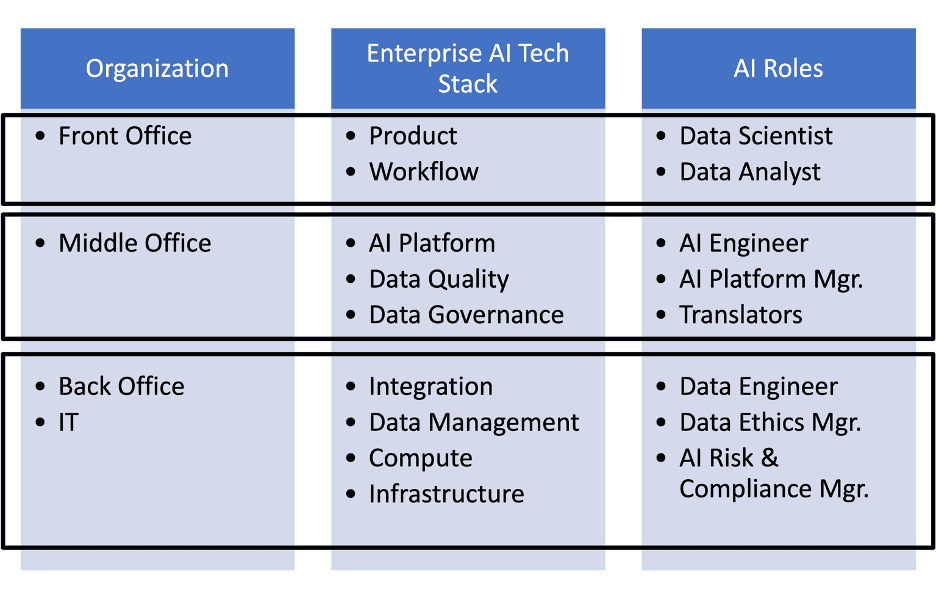

Embracing AI as an Executive

Disruptive forces of AI will impact every industry…including yours! By 2030, the accelerated impact of AI and automation will produce net gains in STEM and healthcare while net decrease in production, food, office support, etc. I call this The Big Transition! In response, enterprises are looking for AI related skills. Some of the newer job titles include chief AI officer, AI engineer, AI specialist, AI advisor, in addition to the more familiar role of data scientist. So, how to embrace The Big Transition?

AI in Financial Services

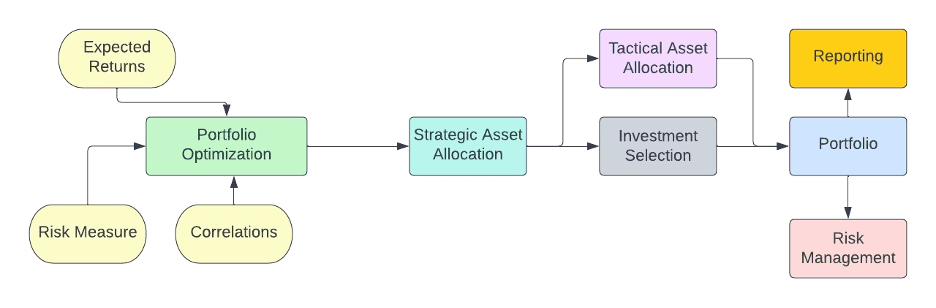

Current Portfolio construction techniques rely on inputs that carry estimation errors which could result in mismatch between expectations and actual outcomes. AI can be applied to every step of the investment workflow to enable portfolio managers with better confidence of their portfolio behavior and performance.

AI Hype VS Reality

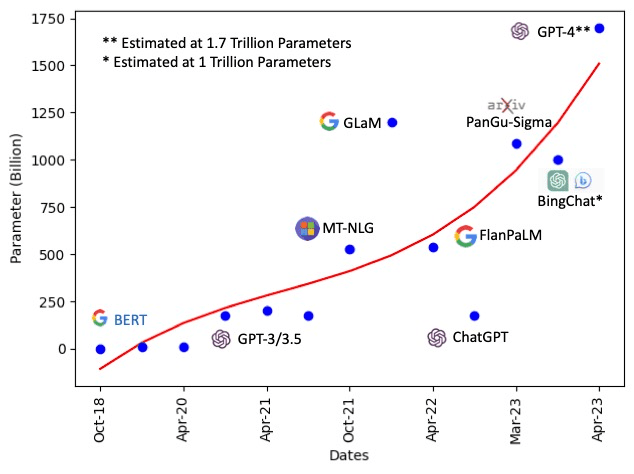

It has been a year of breakneck speed for the development of AI, driven by Large Language Models (LLMs) also called Generative AI. One look at this graph, shows the explosion of AI within the last year compared to the last 50 years! We examined two real life uses cases in the financial sector, one for portfolio optimization and another for predicting the S&P 500 value index. Findings are promising, however, not a panacea. In addition, scale deployments by the industries is lagging. Why? As a practitioner in the field for more than a decade, I see these barriers...

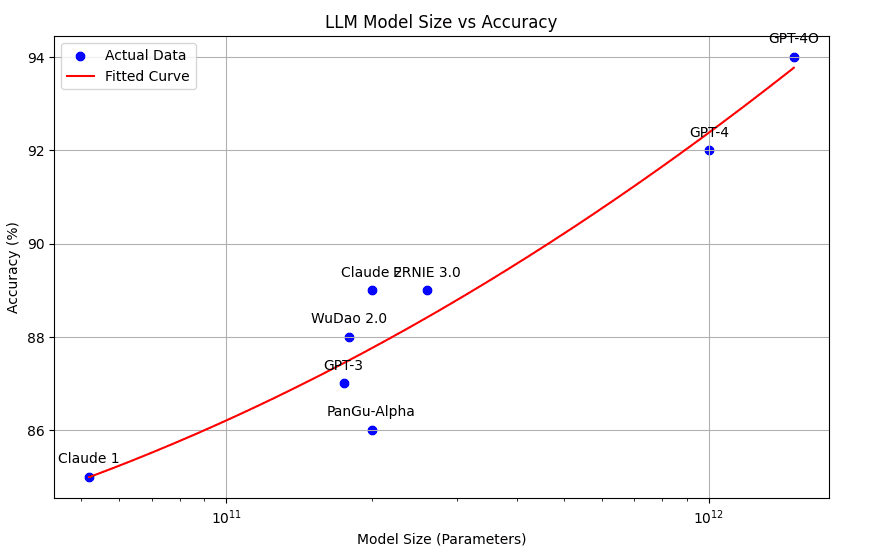

Are We there Yet?

The race to larger Large Language Models (LLMs) has reached a new high. The generative AI models sizes, measured by the number of parameters, have grown 5000X in the last five years! The latest OpenAI GPT-4 is rumored to be 1.7 Trillion parameters! These incredible innovations were achieved by a handful of labs around the world some of which are shown in the graph below. They have shown that these model architectures can be scaled and have achieved remarkable results in many fields. These achievements come with costs including huge compute power, massive data sets, and lots of human feedback.

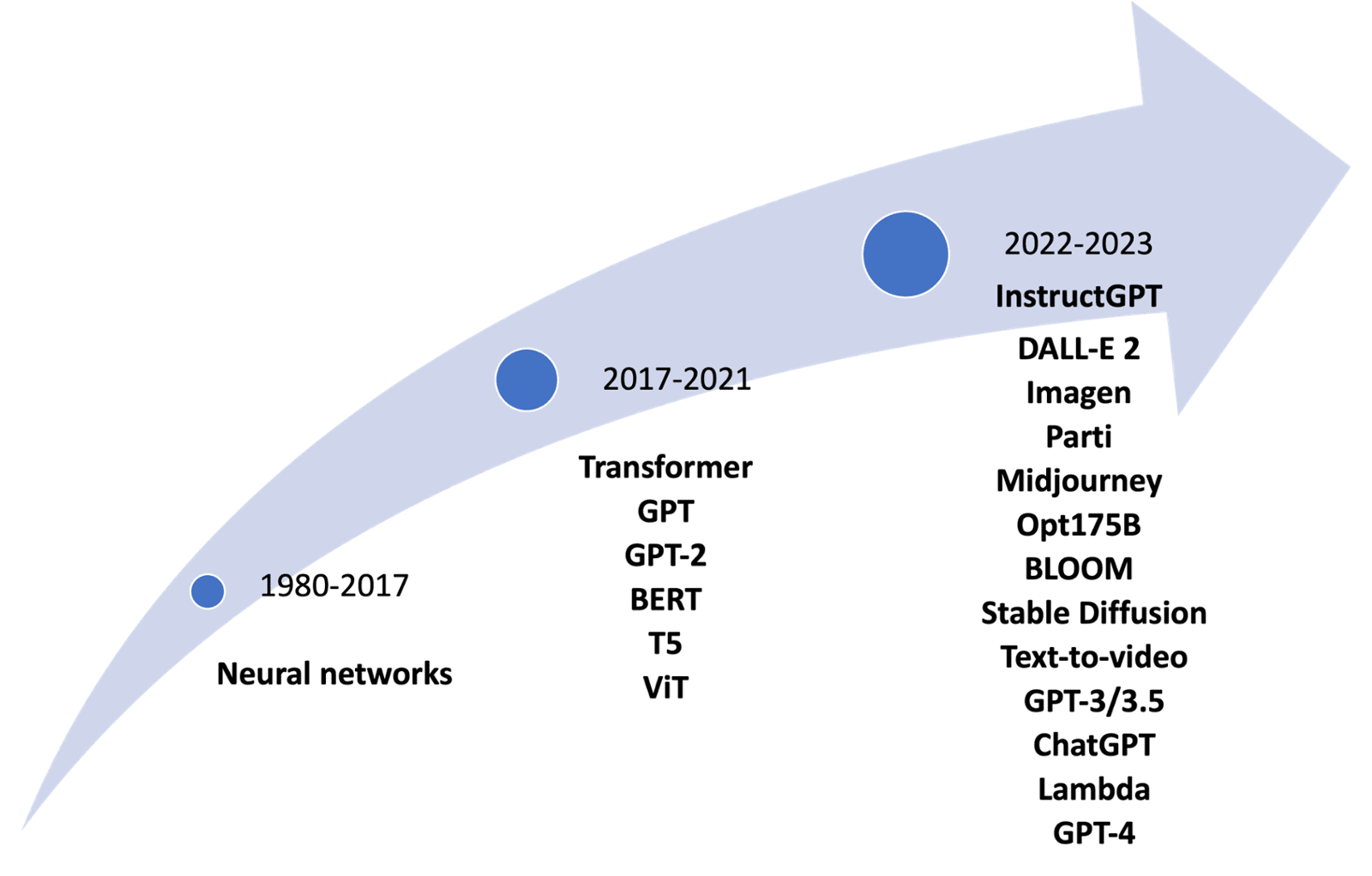

AI Innovation: Past, Present, Future

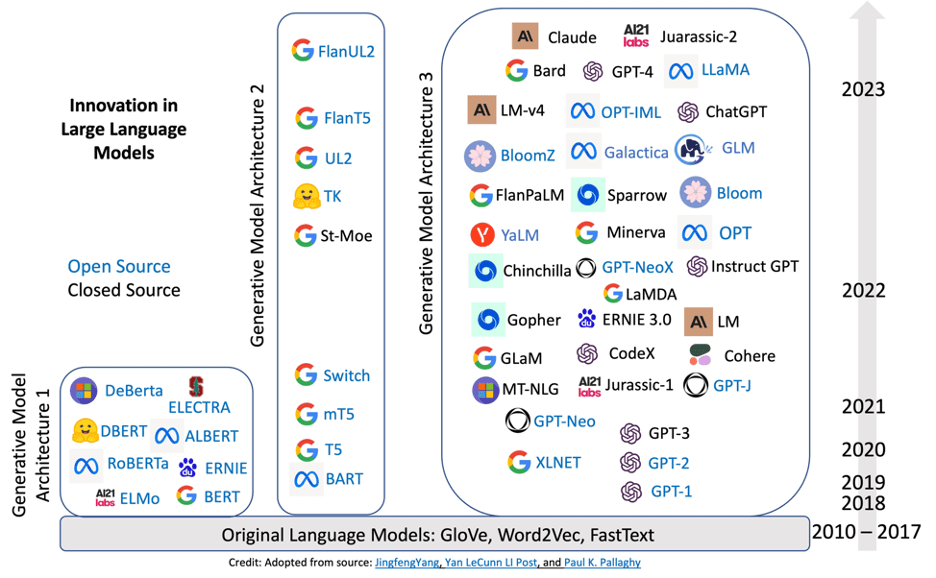

Large Language Models (LLMs) has demonstrated the transformative power of AI. To sort out where we are headed, we need to examine the evolution of “Generative AI”. Graphic visualization shown is here, with more details here. Key points are: 1) all new capabilities of Large Language Models (LLMs) have happened in the last 5 years of the 50 years since its inception! 2) the pace of future development is highly dependent on whether creators open-source or restrict their models. Today, there is a healthy ecosystem of open-source projects allowing wide range of startups and researchers to build on top of these pre-trained models.

Crypto: The Good, Bad, and Ugly

This issue of the Digital HUB focuses on the crypto assets. In light of the recent crypto meltdowns, the key takeaways are: 1) in a hyped and un-regulated market, such as crypto, investor knowledge and education are essential; 2) for now, the crypto market and traditional financial markets are reasonably separated limiting the larger risks; 3) Regulations could be coming soon; 4) Due diligence with focus on valuations and corporate governance is key.